The Importance of Accurate Reconciliation for eCommerce Businesses

In the dynamic world of eCommerce, where transactions occur rapidly and through multiple channels, maintaining accurate financial records is crucial. Reconciliation, the process of comparing financial records to source documents, ensures that all transactions are accounted for, preventing errors, fraud, and missed opportunities. For eCommerce businesses, reconciliation becomes even more complex due to the high volume of transactions, multiple payment gateways, and varying sales channels.

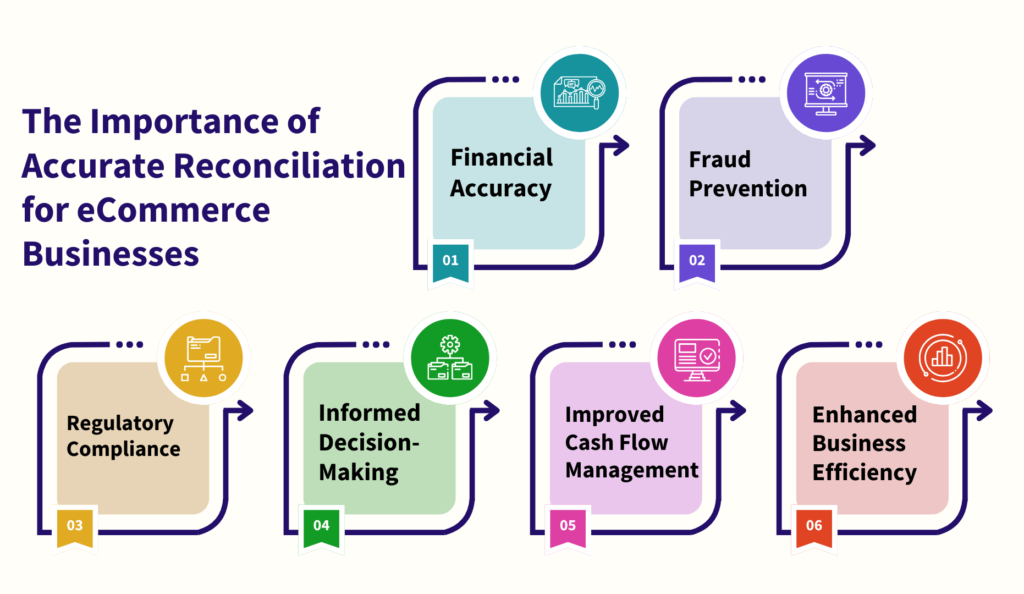

Accurate reconciliation provides several benefits for eCommerce businesses:

- Financial Accuracy: It ensures that all transactions are recorded correctly, preventing errors and discrepancies in financial statements.

- Fraud Prevention: By identifying and investigating discrepancies, reconciliation helps detect and prevent fraudulent activity.

- Regulatory Compliance: Accurate financial records are essential for complying with tax laws and other regulations.

- Informed Decision-Making: Reconciliation provides valuable insights into your business’s financial performance, enabling you to make informed decisions.

- Improved Cash Flow Management: By identifying and resolving discrepancies, reconciliation helps improve cash flow management.

- Enhanced Business Efficiency: Streamlined reconciliation processes save time and resources, allowing you to focus on other important aspects of your business.

How Xero Simplifies the Reconciliation Process

Xero, a cloud-based accounting software, has revolutionized the way businesses manage their finances. Its intuitive interface and powerful features make it an ideal tool for eCommerce businesses seeking to streamline their reconciliation process. Here’s how Xero simplifies reconciliation:

- Bank Feeds: Xero automatically imports bank transactions, saving time and reducing the risk of manual errors.

- Bank Reconciliation: Xero’s bank reconciliation feature allows you to easily match bank statements to transactions in your accounts.

- Multiple Currencies: Xero supports multiple currencies, making it easy to reconcile international transactions.

- Customizable Reports: Xero’s customizable reports provide valuable insights into your business’s financial performance.

Step-by-Step Guide to Reconciling Transactions in Xero

1.Import Bank Statements:

- Connect your bank accounts to Xero.

- Xero will automatically import bank transactions.

2.Review and Categorize Transactions:

- Review the imported transactions.

- Categorize each transaction to the correct account.

- Assign appropriate tax codes and tracking categories.

3.Match Transactions:

- Match bank transactions to corresponding transactions in Xero.

- Use Xero’s matching suggestions or manually match transactions.

- For unmatched transactions, investigate and resolve the discrepancies.

4.Review and Reconcile:

- Review the reconciled transactions to ensure accuracy.

- Identify and resolve any discrepancies or errors.

- Once satisfied, reconcile the bank account.

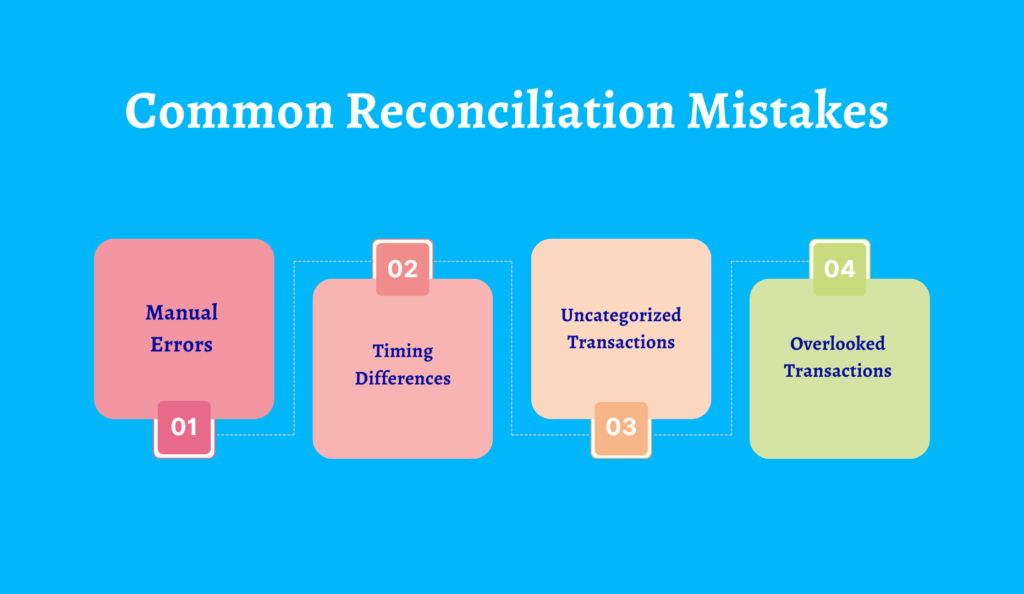

Common Reconciliation Mistakes and How to Avoid Them

- Manual Errors:

- Minimize manual data entry by using bank feeds and automated matching.

- Double-check all entries for accuracy.

- Timing Differences:

- Be aware of timing differences between bank statements and transaction records.

- Consider the processing time for payments and transfers.

- Uncategorized Transactions:

- Establish a clear categorization system and train your team to use it consistently.

- Regularly review and categorize uncategorized transactions.

- Overlooked Transactions:

- Regularly review bank statements and transaction lists to identify any missing transactions.

- Use Xero’s reporting features to identify unusual activity.

How eCloud Experts Assist with Xero Reconciliation Services

eCloud Experts, a leading provider of cloud accounting solutions, offers comprehensive Xero reconciliation services to help eCommerce businesses maintain accurate financial records. Our team of experienced professionals can assist with:

- Bank Reconciliation: We will efficiently reconcile your bank accounts, ensuring that all transactions are accurately categorized and matched.

- Credit Card Reconciliation: We will reconcile your credit card statements, including foreign currency transactions and chargebacks.

- Sales Channel Reconciliation: We will reconcile sales from multiple channels, such as Amazon, eBay, and Shopify, to ensure accurate revenue recognition.

- Inventory Reconciliation: We will reconcile your inventory levels, ensuring that stock levels are accurate and up-to-date.

- Month-End Close: We will assist with the month-end close process, including preparing financial reports and analyzing key performance indicators.

By outsourcing your Xero reconciliation to eCloud Experts, you can free up valuable time and resources, improve the accuracy of your financial records, and gain greater insights into your business’s financial performance.

Conclusion

Accurate reconciliation is essential for eCommerce businesses to maintain financial health and make informed decisions. Xero’s powerful features can simplify the reconciliation process, but it’s important to be aware of common mistakes and take steps to avoid them. By following the steps outlined in this guide and considering professional assistance from eCloud Experts, you can master Xero reconciliation and ensure the financial success of your eCommerce business.