Switching to cloud accounting can feel exciting, but it often comes with a big question: What happens to all my data? If you’re preparing to move to QuickBooks Online, understanding exactly what migrates and what stays behind is critical. Too many businesses assume everything transfers automatically—only to discover missing payroll history, custom reports, or reconciliations after the switch.

This guide explains the truth about QuickBooks migration data and provides a step-by-step QuickBooks migration checklist so you can migrate with confidence.

QuickBooks Migration Data: What It Really Means

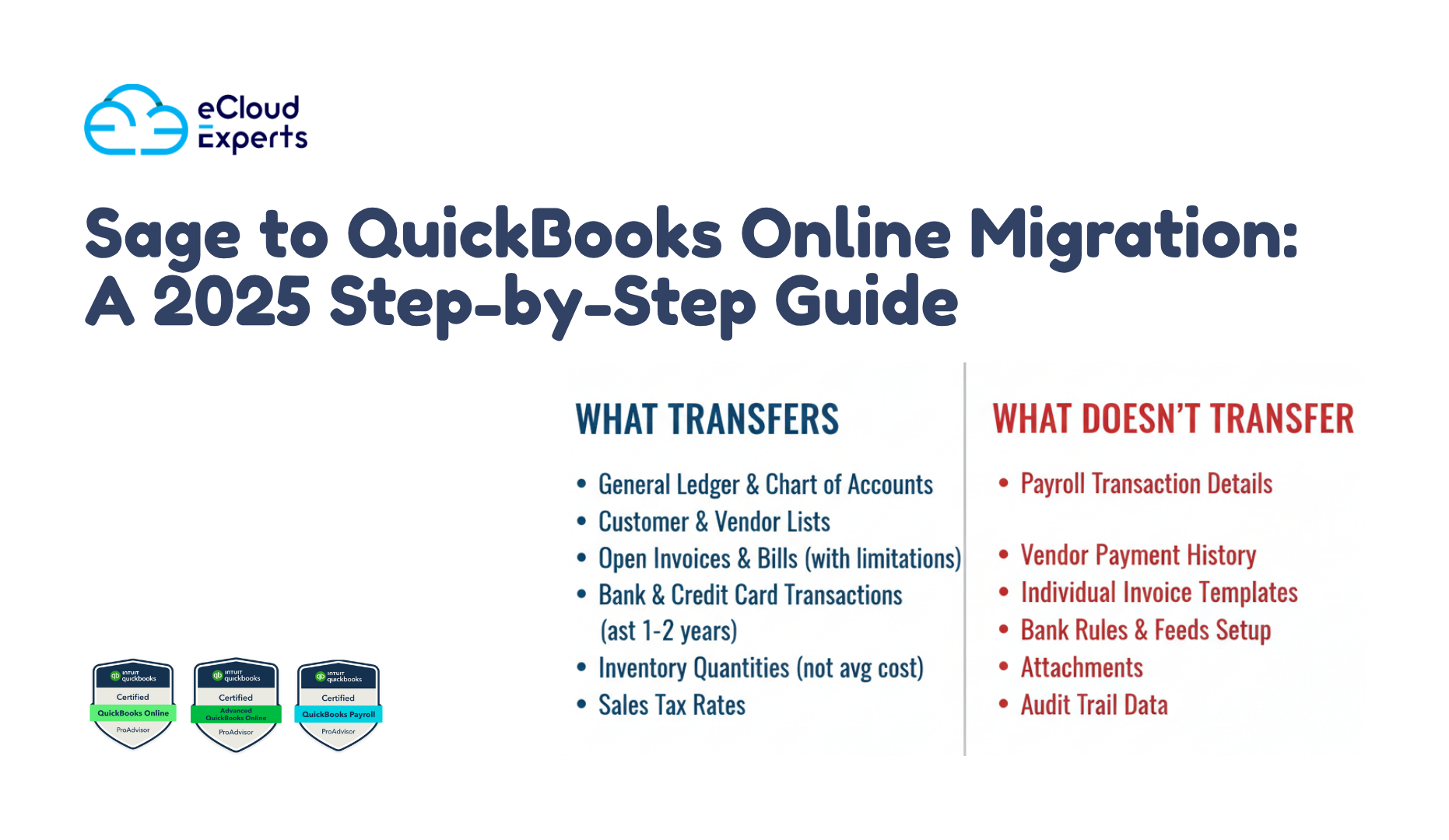

When people hear “migration,” they imagine a simple copy-paste of all records into a new system. But QuickBooks migration data isn’t that straightforward. Some information transfers seamlessly, while other parts require manual work or won’t move at all.

Here’s what “data transfer” really means in accounting terms:

- Master records like customers, vendors, and accounts will usually move across.

- Transactional history transfers in varying detail, depending on the source file.

- Certain items like audit logs or custom templates—never migrate.

This is why many businesses hit snags when they first move to QuickBooks Online. They expect a complete replica, but QuickBooks has data format limitations. Without preparation, you risk:

- Lost transaction history

- VAT/GST mismatches

- Duplicate customers or vendors

- Misaligned opening balances

Understanding these risks upfront makes your QuickBooks migration checklist even more valuable.

QuickBooks Migration Checklist: What Transfers Smoothly

If you’re worried about losing critical information, here’s the good news—lots of QuickBooks migration data does move successfully. Below is a breakdown of the key records that typically migrate without issue.

- Customer Information

All customer names, contact details, and outstanding balances usually transfer. - Vendors/Suppliers

Similar to customers, vendor records with unpaid bills and contact information are included in your QuickBooks data transfer. - Chart of Accounts

Your account list—including categories like Assets, Liabilities, Income, and Expenses—moves across. This ensures financial structure continuity. - Opening Balances

Current balances for accounts, customers, and suppliers are preserved during migration. - Products & Services List

Item records, including SKUs and descriptions, transfer to QuickBooks Online. - Tax Codes

Standard VAT/GST codes move, although special tax treatments may need adjustment. - Attachments (Partially)

Some attachments like invoices or bills can move, but not all documents are guaranteed.

Having this QuickBooks migration checklist handy reassures you that the core elements of your business will remain intact when you move to QuickBooks Online.

What Doesn’t Transfer Automatically When You Move to QuickBooks Online

While much of your QuickBooks migration data transfers, there are important gaps. These often surprise businesses after the move. Knowing what doesn’t transfer helps you plan in advance.

- Custom Reports

Any specialized reporting you created in your old software won’t migrate. You’ll need to rebuild reports in QuickBooks Online. - Bank Reconciliations

Completed reconciliations do not carry over. You’ll need to recheck or re-perform reconciliations post-migration. - Audit Trail History

QuickBooks Online starts fresh with its own audit log. Past audit trail entries will not be visible. - Payroll Data

Payroll records rarely transfer. If payroll is critical, you’ll need to import summaries manually or start fresh in QuickBooks Payroll. - Budgets & Forecasts

These must be manually recreated in QuickBooks Online. - Multi-Currency Adjustments

Currencies may transfer, but past exchange rate adjustments may not align perfectly.

Recognizing these QuickBooks Online data limitations allows you to prepare backups and avoid nasty surprises. This is one of the most overlooked areas in any QuickBooks migration checklist.

QuickBooks Migration Issues: Common Problems to Watch For

Even when you know what transfers and what doesn’t, some businesses face unexpected QuickBooks migration issues. These problems can delay your transition or create messy books if not handled early.

Here are the most frequent pitfalls:

- Formatting Conflicts

If your old records contain invalid characters, QuickBooks may reject them. - Duplicate Transactions

Sometimes, invoices and bills import twice, throwing off balances. - Missing VAT/GST Mapping

VAT or GST codes may not map directly, causing compliance issues. - File Size Limitations

Large company files may fail to import fully. - Lost Attachments

Supporting files like receipts may not transfer.

By identifying these QuickBooks migration data issues upfront, you can correct them before going live. This is why a professional QuickBooks conversion service often saves time and stress.

QuickBooks Migration Checklist: Steps to Prepare Before You Move

Preparation is everything when you’re planning to move to QuickBooks Online. Without it, migration errors multiply. Use this QuickBooks migration checklist to get your books ready before pressing “import.”

- Clean Your Data

Remove duplicate vendors, inactive customers, and unused accounts. - Reconcile Before Migration

Finish bank reconciliations in your old system so balances match. - Back Up Your Old File

Always keep a secure backup of your old accounting software. - Run a Test Migration

Import a small sample to check how records look in QuickBooks Online. - Validate Reports Post-Migration

Compare profit & loss, balance sheet, and trial balance to confirm accuracy.

These steps form the backbone of every QuickBooks migration checklist. Skipping them almost guarantees post-migration headaches. If you’d rather not take the risk, consider hiring a QuickBooks conversion service.

Do You Need a QuickBooks Conversion Service?

Not every business needs professional help to move to QuickBooks Online. If you run a small operation with simple accounts, you might manage a DIY migration using Intuit’s tools.

But when complexity increases, expert help becomes essential. You should consider a QuickBooks conversion service if:

- You use payroll with years of history.

- You operate in multiple currencies.

- You manage VAT/GST compliance across regions.

- Your company file contains thousands of transactions.

- You need custom reporting rebuilt.

Hiring professionals ensures your QuickBooks migration data is handled correctly, saving hours of cleanup later. At eCloud Experts, we’ve built our reputation on guiding businesses through these migrations. Our specialists use proven checklists and advanced tools to ensure your switch is accurate, compliant, and stress-free.

Conclusion: Migrate with Confidence

Migrating to QuickBooks Online doesn’t have to be overwhelming. Once you understand which QuickBooks migration data transfers and which doesn’t, you can take control of the process. With the right QuickBooks migration checklist, you’ll avoid surprises and feel confident that your accounts are accurate.

Remember:

- Customer, vendor, and chart of accounts data transfer smoothly.

- Reports, reconciliations, and payroll data require extra work.

- Preparation reduces QuickBooks migration issues.

- A QuickBooks conversion service can save time and reduce errors.

Ready to start your migration? Get in touch with eCloud Experts today for a personalized QuickBooks migration checklist and free consultation. Our team is here to make your switch seamless, accurate, and built for growth.