Migrating accounting data to QuickBooks Online (QBO) can significantly enhance efficiency and enable real-time financial reporting for your business. However, migration errors and discrepancies can arise, leading to financial mismanagement, compliance risks, and reporting inconsistencies. To fully leverage the benefits of QuickBooks Online, businesses must ensure that their financial data is accurately transferred and optimized for use in the new system.

Common Reasons for Migration Errors

The process of migrating financial data to QBO is intricate, and several challenges can arise. Understanding these potential pitfalls helps businesses mitigate risks and achieve a smooth transition. Below are some common migration errors:

1. Data Mapping Issues

- When migrating from software such as Sage, Xero, or another accounting system, discrepancies in field mapping can lead to data being misaligned.

- Incorrect categorization of transactions and accounts can result in inaccurate financial reports.

2. Incomplete Data Transfers

- If crucial financial data is not fully transferred, businesses may face missing records, affecting financial statements and reconciliations.

- Transactions, invoices, and expense details may be omitted due to file format mismatches or compatibility issues.

3. Overpayment Allocation Errors

- Overpayments made to vendors or received from customers may be misclassified, causing incorrect balance calculations.

- This can create confusion in account reconciliation and impact accounts payable and receivable management.

4. Unapplied Payments on Account

- Payments recorded but not correctly linked to corresponding invoices can lead to unbalanced accounts.

- This results in inflated outstanding balances, leading to discrepancies in financial statements.

5. Multi-Currency Conversion Mistakes

- Businesses operating in multiple currencies must ensure that exchange rates are correctly applied during migration.

- Errors in currency conversion can impact profit margins, tax calculations, and financial reporting accuracy.

6. Manual Entry Errors

- Human errors, such as typos, duplicate entries, or incorrect transaction dates, can cause serious financial discrepancies.

- Automated migration tools must be used carefully, ensuring proper validation steps are in place.

7. Payroll Data Discrepancies

- Employee payroll records, tax deductions, and benefit contributions must be accurately mapped to avoid incorrect salary payments and compliance issues.

- Payroll tax liabilities may also be affected by migration errors, leading to IRS or local tax authority penalties.

8. Chart of Accounts Misalignment

- If the structure of the old accounting system does not align with QBO’s format, accounts may not be properly classified.

- This can affect financial reporting and tax filing.

9. Missing Tracking Category Assignments

- Businesses using classes, locations, or other tracking categories must ensure these are accurately migrated.

- If not properly assigned, it can lead to incorrect reporting and analysis.

10. Improper Opening Balance Setup

- An incorrect opening balance can lead to reconciliation issues in bank accounts, credit card statements, and vendor balances.

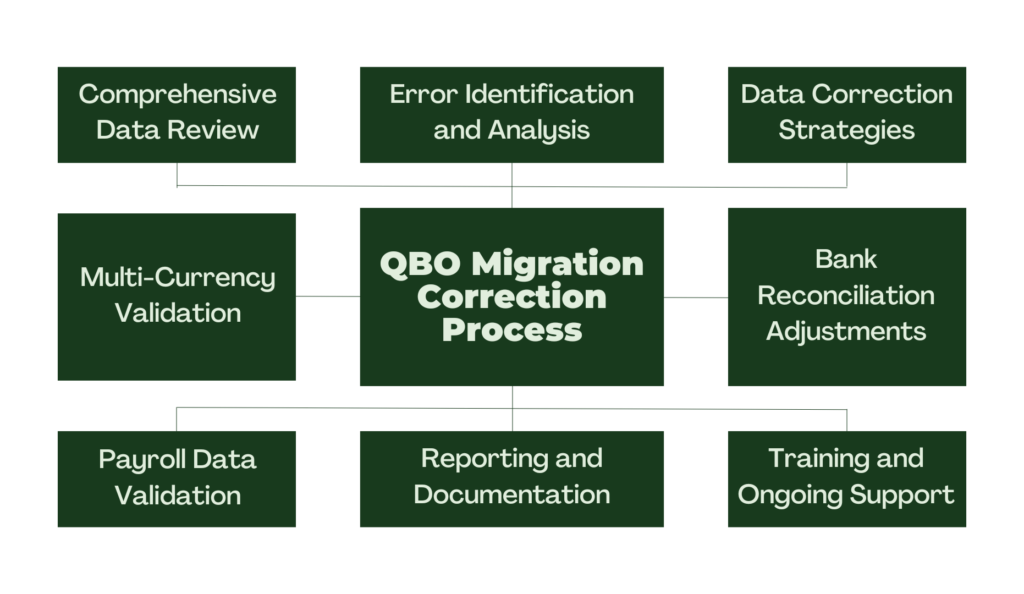

QuickBooks Online Migration Correction Process

To address these migration challenges, a structured correction process is essential. The following steps ensure that your financial data in QuickBooks Online is accurate and optimized:

Step 1: Comprehensive Data Review

- Conduct a detailed comparison between original financial records and migrated data.

- Identify missing transactions, duplicated entries, or misclassified accounts.

Step 2: Error Identification and Analysis

- Pinpoint specific discrepancies in account balances, payroll records, tax liabilities, and other key financial data.

- Use QuickBooks’ built-in tools such as audit logs and reports to identify inconsistencies.

Step 3: Data Correction Strategies

- Adjust misclassified accounts and transactions to align with the correct reporting structure.

- Reclassify payments, invoices, and expenses to ensure accuracy in financial statements.

- Manually enter or re-import any missing data to ensure a complete financial record.

Step 4: Multi-Currency Validation

- Verify foreign exchange rates applied during migration and adjust any discrepancies.

- Ensure all transactions reflect the correct currency values and tax calculations.

Step 5: Bank Reconciliation Adjustments

- Reconcile bank statements, credit card transactions, and vendor accounts.

- Adjust any opening balances to match actual financial records.

Step 6: Payroll Data Validation

- Cross-check employee records, tax withholdings, and benefits contributions to prevent payroll errors.

- Ensure compliance with tax authorities by aligning payroll records with actual payments made.

Step 7: Reporting and Documentation

- Generate detailed reports on all corrections made for transparency and audit purposes.

- Provide documentation on how to maintain accurate records in QuickBooks Online moving forward.

Step 8: Training and Ongoing Support

- Conduct training sessions for your team on how to efficiently use QBO and avoid future errors.

- Provide post-migration support to resolve any additional issues that arise.

Benefits of Migration Correction Services

1. Enhanced Data Integrity

- Ensures your financial data is accurate and reliable, preventing costly errors.

2. Improved Financial Decision-Making

- With accurate reports, businesses can make informed decisions regarding budgeting, investments, and strategic planning.

3. Reduced Compliance Risks

- Avoid penalties and audits by ensuring tax filings, payroll, and financial statements are accurate.

4. Streamlined Accounting Processes

- A well-migrated QuickBooks Online setup improves efficiency, allowing businesses to leverage automation features.

5. Increased Confidence in Business Operations

- Business owners and financial managers can rely on QBO for accurate, real-time financial insights.

Conclusion

Migrating to QuickBooks Online is a transformative step for businesses seeking efficiency and real-time financial insights. However, errors in migration can lead to serious financial mismanagement and compliance risks. Addressing these challenges through a structured migration correction process ensures data accuracy, financial integrity, and business growth.

Expert Migration Assistance with eCloud Experts

eCloud Experts, a trusted QuickBooks Online migration specialist, provides comprehensive correction services to ensure your data is properly aligned. Our experienced team helps businesses of all sizes resolve migration discrepancies, enhance financial reporting, and optimize their accounting systems.

Don’t let migration errors hinder your business success. Partner with eCloud Experts to ensure a seamless transition to QuickBooks Online. Contact us today to achieve data accuracy and unlock the full potential of QuickBooks Online!