In today’s fast-paced business environment, financial processes must be both efficient and secure. However, for businesses utilizing Xero, managing approvals manually often results in unnecessary delays, administrative bottlenecks, and compliance risks. Without a streamlined approval process, finance teams struggle with lost paperwork, inconsistent spending controls, and a lack of real-time financial visibility.

The integration of ApprovalMax with Xero provides a robust solution by automating financial approvals, enforcing internal control policies, and optimizing financial workflows. By leveraging ApprovalMax Xero automation, businesses can enhance efficiency, improve compliance, and strengthen financial oversight.

In this article, we will explore the core benefits of automating financial approvals with ApprovalMax and Xero, demonstrating how this integration improves efficiency and transparency. Furthermore, we will highlight how eCloud Experts can assist businesses in successfully implementing and optimizing this powerful automation solution.

The Core Benefits of Automating Approvals

1. Enhanced Efficiency and Time Savings

A well-structured approval workflow plays a crucial role in improving operational efficiency. Automating approval processes in Xero with ApprovalMax eliminates time-consuming manual tasks and speeds up decision-making.

- Eliminates redundant manual processes: Traditional approval workflows involve a series of emails, spreadsheets, and paper-based approvals, which can be inefficient and error-prone. ApprovalMax digitizes and automates these workflows, ensuring quicker processing times.

- Minimizes approval delays: Automated notifications and role-based approvals ensure that relevant stakeholders receive immediate alerts, reducing unnecessary waiting times.

- Reduces administrative workload: Finance teams can avoid constant follow-ups with approvers, allowing them to focus on strategic financial planning and analysis.

- Boosts productivity: By automating financial approvals, employees spend less time on administrative work and more time on value-added activities that drive business growth.

2. Improved Spending Control and Budget Adherence

Financial discipline is essential for sustainable business operations. ApprovalMax enforces pre-configured approval rules, ensuring that spending decisions align with organizational budgets and policies.

- Prevents unauthorized expenditures: With a structured approval process, unauthorized transactions are eliminated, reducing the risk of financial mismanagement.

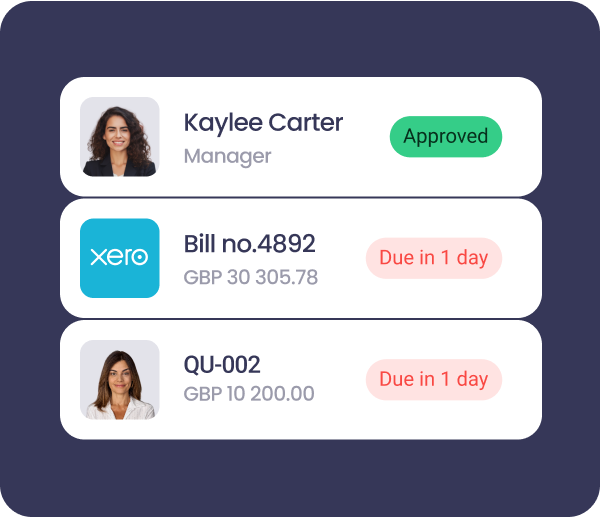

- Implements multi-tier approval hierarchies: ApprovalMax enables businesses to establish approval workflows based on budget thresholds, roles, and departments, ensuring all financial decisions pass through the appropriate levels of authorization.

- Enhances budget control and forecasting: With real-time insights into pending approvals and historical transactions, finance teams gain greater visibility into spending trends and budget adherence.

- Minimizes financial risks: Automated spending control with ApprovalMax and Xero ensures that purchases align with corporate budgets, preventing overspending and promoting financial stability.

3. Strengthened Financial Control and Compliance

Financial governance is a priority for organizations looking to maintain regulatory compliance and ensure accountability. ApprovalMax provides an extensive audit trail for every approval decision, making it easier for businesses to track financial transactions and maintain compliance.

- Enhances audit readiness: Every approval is logged, timestamped, and documented within the system, allowing businesses to meet regulatory and audit requirements effortlessly.

- Ensures compliance with financial policies: With enforced approval workflows, finance teams can ensure all transactions adhere to internal policies and external regulatory requirements.

- Increases transparency: A detailed audit trail of approvals in Xero allows businesses to monitor who approved transactions and under what conditions, promoting financial accountability.

- Improves financial governance: Organizations can set predefined rules that align with industry regulations, reducing the risk of non-compliance and financial mismanagement.

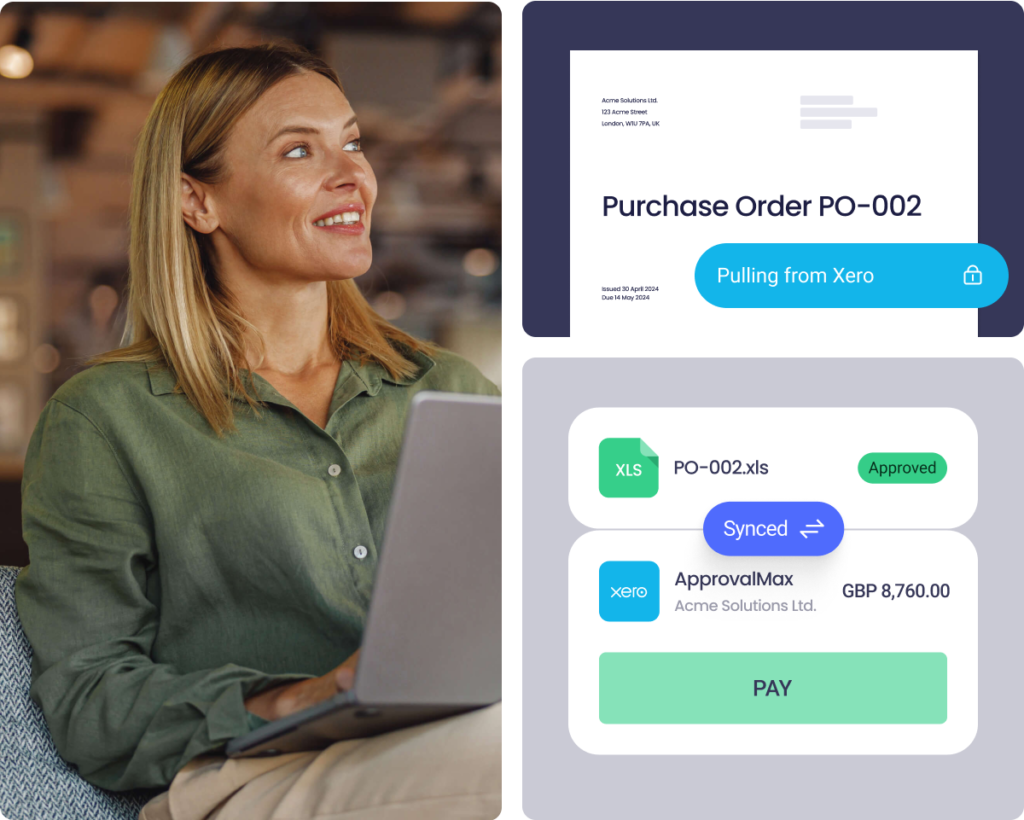

4. Streamlined Purchase Order and Invoice Approval Processes

Manual purchase order approvals and invoice approvals in Xero are prone to inefficiencies, leading to delays and miscommunication. ApprovalMax automates the entire workflow, ensuring seamless processing.

- Automates purchase order approvals: By setting up predefined criteria, ApprovalMax ensures that purchase requests are routed to the appropriate approvers before commitment.

- Speeds up invoice approvals: Invoices are automatically directed to the correct personnel, eliminating bottlenecks and reducing payment processing times.

- Minimizes disputes with vendors: Automated workflows ensure that invoices are approved accurately and promptly, fostering better supplier relationships and avoiding late payment penalties.

- Enhances operational efficiency: By integrating purchase order automation in Xero, businesses can ensure a faster, error-free approval cycle that aligns with company policies.

5. Reduced Errors and Increased Accuracy

Manual approval processes are vulnerable to human errors, leading to financial discrepancies and operational inefficiencies. By automating financial approvals, organizations can significantly enhance data accuracy and reliability.

- Prevents duplicate payments: Automated validation rules ensure that duplicate invoices or approvals do not enter the system.

- Reduces data entry errors: Integrated with Xero, ApprovalMax pulls financial data directly from the system, minimizing manual input and associated errors.

- Improves reporting accuracy: A modernized finance workflow ensures real-time data synchronization, improving financial forecasting and reporting.

- Enhances financial decision-making: With reliable and accurate data, finance managers can make informed strategic decisions, ensuring sound financial management.

6. Real-Time Visibility and Reporting

With ApprovalMax’s cloud-based approval system, finance teams gain real-time visibility into approval workflows, ensuring better financial oversight.

- Increases operational transparency: Finance teams can track the status of approvals and pending transactions at any time, reducing uncertainty.

- Enhances reporting and forecasting: By integrating with Xero, real-time data insights help businesses plan and allocate resources efficiently.

- Empowers proactive financial decision-making: Instant access to approval trends and spending patterns enables finance leaders to make timely and informed decisions.

7. Seamless Integration with Xero

ApprovalMax integrates seamlessly with Xero, eliminating the need for manual data transfers and ensuring a smooth approval process.

- Automates data synchronization: Approved transactions automatically sync with Xero, reducing administrative workload and increasing accuracy.

- Enhances financial security: The integration ensures that all approvals follow predefined security protocols, preventing unauthorized modifications.

- Supports business scalability: Whether for small businesses or large enterprises, ApprovalMax for Xero provides a scalable solution that adapts to growing financial management needs.

How eCloud Experts Can Help You Achieve Approval Automation Success

While the advantages of ApprovalMax Xero automation are compelling, successful implementation requires specialized expertise. This is where eCloud Experts excels.

Why Choose eCloud Experts?

At eCloud Experts, we specialize in Xero ApprovalMax integration services, ensuring businesses maximize the benefits of approval automation. Our comprehensive services include:

- End-to-end implementation: We configure ApprovalMax to align with your financial workflows.

- Customized approval workflows: Tailoring solutions to your business’s specific needs.

- Seamless integration with Xero: Ensuring real-time data accuracy and streamlined approval processes.

- Ongoing training and support: Empowering your team with knowledge and technical assistance.

With a proven track record in automating financial approvals, our experts help businesses optimize their financial operations and enhance efficiency.

Conclusion

Embracing ApprovalMax Xero automation delivers transformative benefits, from enhanced efficiency and compliance to streamlined financial workflows and real-time insights. By partnering with eCloud Experts, businesses can leverage expert guidance and support to unlock the full potential of automated approval workflows.

Ready to experience the benefits of automated approvals with ApprovalMax and Xero? Contact eCloud Experts today for a free consultation and take the first step toward financial automation and efficiency!