The Indispensable Role of Payroll in eCommerce

Payroll, often overlooked as a mere administrative task, is a critical component of any successful eCommerce business. It’s more than just disbursing salaries; it’s about ensuring timely, accurate, and compliant payments to employees. For eCommerce businesses, with their unique operational dynamics and often remote workforces, efficient payroll management becomes even more crucial.

Automating Payroll with Xero: A Game-Changer

Xero, a cloud-based accounting software, offers a robust payroll solution designed to streamline the entire process. By automating salary payments, tax calculations, and compliance checks, Xero significantly reduces the administrative burden on businesses. This automation frees up valuable time for eCommerce entrepreneurs to focus on core business activities, such as marketing, product development, and customer service.

A Step-by-Step Guide to Xero Payroll Setup

Setting up Xero payroll is a relatively straightforward process. However, to ensure accuracy and compliance, it’s essential to follow these steps:

1. Create an Xero Account:

- If you don’t already have one, sign up for a Xero account.

- Choose a suitable pricing plan based on your business needs.

2. Add Your Business Details:

- Provide essential information about your business, including its legal structure, industry, and address.

- Set up your chart of accounts to categorize income and expenses.

3. Set Up Your Employees:

- Add each employee to your Xero payroll system.

- Input their personal details, such as name, address, tax file number (or equivalent), and payment details.

- Specify their employment type (full-time, part-time, or contractor) and their pay rate.

4. Configure Pay Runs:

- Determine your pay period frequency (weekly, fortnightly, or monthly).

- Set up pay run templates to automate the process of calculating salaries, deductions, and taxes.

- Customize pay slips to include relevant information for each employee.

5. Manage Leave and Time Off:

- Set up leave accrual rules and track employee leave balances.

- Configure timesheets to record employee hours worked.

- Integrate with time and attendance systems if applicable.

6. Process Payroll:

- Run payroll on the specified pay run date.

- Review the pay run summary to ensure accuracy.

- Approve the pay run to generate payslips and payment files.

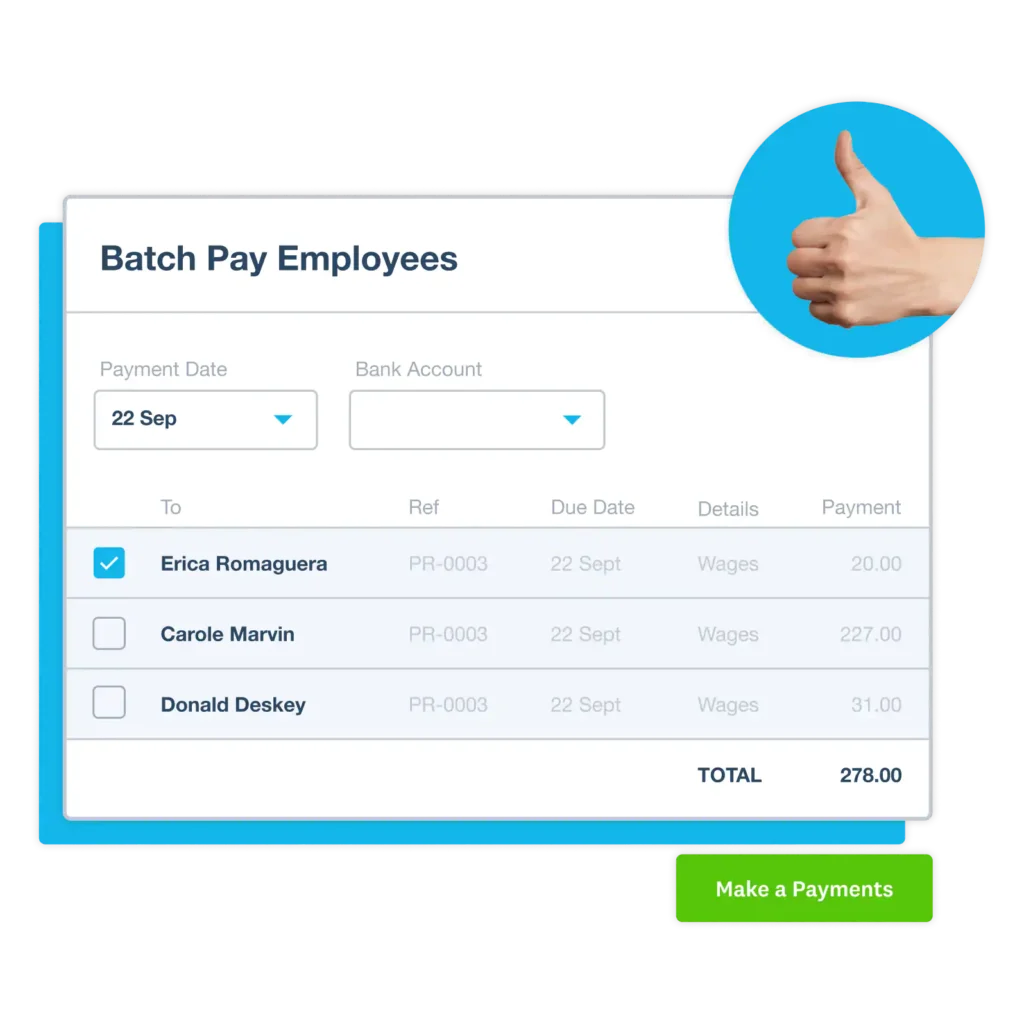

7. Make Payments:

- Xero can integrate with your bank account to automatically transfer salaries to employees.

- Alternatively, you can export payment files to your online banking platform.

Ensuring Compliance with Tax and Regulatory Requirements

One of the most significant advantages of using Xero for payroll is its ability to help businesses stay compliant with tax and regulatory requirements. Xero automatically calculates taxes, such as income tax, payroll tax, and superannuation, based on the latest tax rates and regulations. It also generates the necessary reports and forms to meet compliance obligations.

To ensure ongoing compliance, it’s crucial to:

- Stay Updated on Tax Laws:

- Regularly monitor changes in tax laws and regulations.

- Update your Xero settings to reflect any changes.

- Maintain Accurate Employee Records:

- Keep accurate records of employee information, including their tax file numbers, addresses, and payment details.

- Regularly Review Payroll Processes:

- Conduct periodic reviews of your payroll processes to identify any potential issues or inefficiencies.

- Seek Professional Advice:

- Consult with an accountant or payroll specialist for guidance on complex payroll matters.

Leveraging eCloud Experts for Xero Payroll Setup and Management

While Xero simplifies payroll, setting it up correctly and managing it effectively can still be time-consuming. This is where eCloud Experts can assist. As experienced Xero experts, they can:

- Streamline Setup: Quickly and accurately configure your Xero payroll system.

- Ensure Compliance: Stay updated on the latest tax and regulatory changes.

- Optimize Processes: Identify opportunities to automate and streamline your payroll workflows.

- Provide Ongoing Support: Offer ongoing support and troubleshooting assistance.

By partnering with eCloud Experts, you can maximize the benefits of Xero payroll and focus on growing your eCommerce business.

Conclusion

Xero payroll is a powerful tool that can help eCommerce businesses automate their payroll processes, reduce errors, and ensure compliance. By following the steps outlined in this guide and leveraging the expertise of eCloud Experts, you can effectively manage your payroll and focus on what truly matters: building a successful online business.