Introduction

In today’s fast-paced business environment, efficiency and accuracy are paramount for the smooth functioning of any organization. The bookkeeping and finance department, often the backbone of a business, is no exception. Manual tasks can be time-consuming and prone to errors, hindering productivity and overall financial health. Fortunately, automation tools like Xero can revolutionize these processes, streamlining operations and freeing up valuable resources.

Understanding Xero Automation

Xero is a cloud-based accounting software that offers a suite of automation features designed to simplify bookkeeping and finance tasks. By automating repetitive processes, Xero can significantly enhance efficiency and accuracy. Some key automation features include:

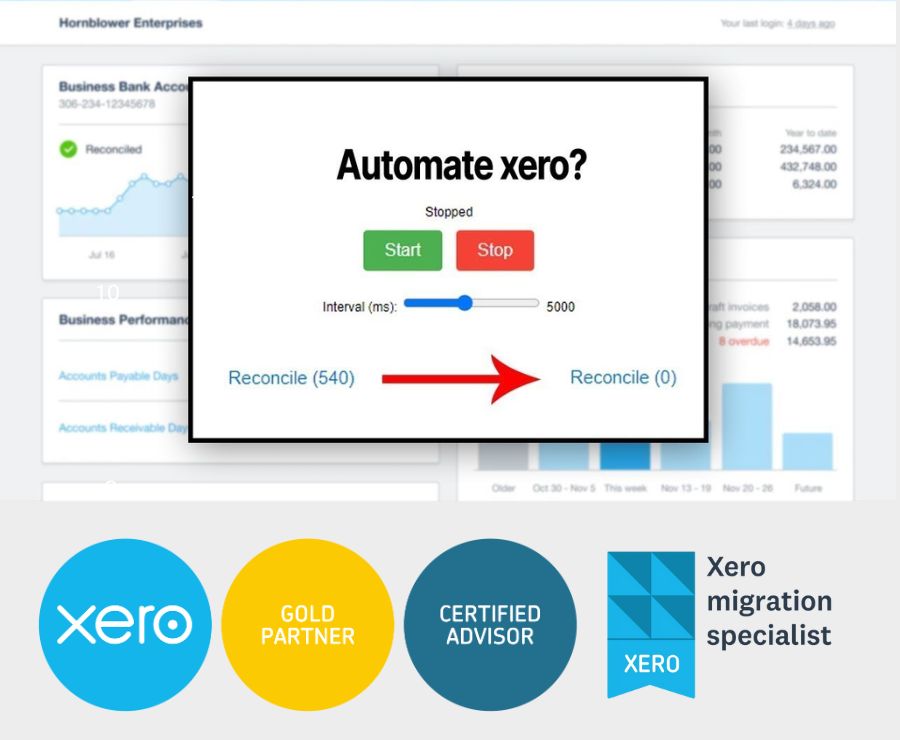

- Automated bank reconciliations: Xero can automatically match bank transactions to invoices and bills, reducing the time and effort required for reconciliation.

- Automated invoicing: Xero allows you to create and send invoices automatically, saving time and reducing the risk of errors.

- Recurring transactions: Set up recurring invoices, bills, and payments to automate regular financial transactions.

- Expense management: Use Xero’s expense tracking features to automate expense approvals, reimbursements, and reporting.

- Report generation: Generate customizable financial reports automatically, providing valuable insights into your business’s financial performance.

Benefits of Xero Automation for Outsourced Finance Departments

Outsourcing finance departments can be a cost-effective solution for small businesses. However, to ensure optimal efficiency and accuracy, it’s essential to leverage automation tools like Xero. Here are some key benefits of Xero automation for outsourced finance departments:

- Improved efficiency: By automating repetitive tasks, Xero allows outsourced finance departments to focus on more strategic activities, such as financial analysis and planning.

- Enhanced accuracy: Automation reduces the risk of human error, ensuring that financial data is accurate and reliable.

- Increased productivity: With Xero automation, outsourced finance departments can complete tasks faster and with greater efficiency.

- Better communication: Xero’s cloud-based platform facilitates real-time collaboration between outsourced finance teams and their clients, improving communication and transparency.

- Cost savings: By streamlining processes and reducing the risk of errors, Xero automation can help outsourced finance departments save time and money.

Tips for Setting Up Automation in Xero

To maximize the benefits of Xero automation, it’s important to set it up correctly. Here are some practical tips:

- Start with the basics: Begin by automating simple tasks like bank reconciliations and recurring transactions.

- Customize your automation rules: Tailor your automation settings to your specific business needs and workflows.

- Regularly review and update your automation settings: As your business evolves, ensure that your automation rules remain relevant and effective.

- Take advantage of Xero’s add-ons: Explore third-party add-ons that can further enhance Xero’s automation capabilities.

Why Choose eCloud Experts for Xero Automation

At eCloud Experts, we specialize in providing expert Xero implementation and support services. Our team of experienced professionals can help you set up and optimize Xero automation to streamline your bookkeeping and finance processes. By choosing eCloud Experts, you can benefit from:

- Tailored Xero solutions: We work closely with our clients to understand their unique needs and develop customized Xero solutions.

- Expert implementation: Our team has extensive experience in implementing Xero automation and can ensure a smooth transition.

- Ongoing support: We provide ongoing support and maintenance to ensure that your Xero system is always running optimally.

- Competitive pricing: We offer competitive pricing for our Xero implementation and support services.

Additional Benefits of Xero Automation for Outsourced Finance Departments

Beyond the core benefits mentioned earlier, Xero automation can also offer several additional advantages for outsourced finance departments:

Improved Data Accuracy and Consistency

- Reduced human error: Automation minimizes the risk of manual data entry errors, ensuring greater accuracy in financial records.

- Consistent application of rules: Automated processes guarantee consistent application of accounting rules and standards, reducing the likelihood of inconsistencies.

Enhanced Financial Reporting and Analysis

- Real-time insights: Automated data entry and processing enable real-time access to financial data, facilitating timely decision-making.

- Advanced reporting capabilities: Xero’s reporting tools allow for the creation of customized financial reports, providing deeper insights into business performance.

Streamlined Audit Preparation

- Organized documentation: Automated processes can help maintain organized documentation, simplifying the audit process.

- Efficient data retrieval: Xero’s cloud-based platform allows for easy access to financial data, reducing the time and effort required for audit preparation.

Improved Scalability and Flexibility

- Adaptability to growth: Xero’s scalable platform can accommodate the changing needs of businesses as they grow and expand.

- Integration with other business tools: Xero integrates seamlessly with other business applications, enhancing overall efficiency and productivity.

Strengthened Security and Compliance

- Data protection: Xero’s cloud-based infrastructure offers robust security measures to protect sensitive financial data.

- Compliance with regulations: Xero can help businesses comply with various accounting and tax regulations.

Real-Time Collaboration and Communication

- Cloud-based platform: Xero’s cloud-based nature enables real-time collaboration and communication between team members, regardless of their location.

- Centralized data access: All team members can access and update financial data from a single platform, ensuring consistency and transparency.

Enhanced Workflow Efficiency

- Automated approvals: Xero’s workflow features allow for automated approvals of invoices, expenses, and other financial transactions, reducing bottlenecks and speeding up processes.

- Task management: Xero can be integrated with task management tools to streamline workflows and improve accountability.

Improved Customer Satisfaction

- Faster invoicing: Automated invoicing can help businesses get paid faster, improving customer satisfaction and cash flow.

- Enhanced customer service: With better access to financial information, outsourced finance departments can provide more efficient and accurate customer service.

Reduced Paperwork and Storage Costs

- Paperless processes: Xero’s digital platform eliminates the need for paper documents, reducing storage costs and environmental impact.

- Electronic signatures: Xero supports electronic signatures, reducing the need for physical signatures and paper-based approvals.

By leveraging these additional benefits, outsourced finance departments can further enhance their efficiency, accuracy, and value to their clients.

Conclusion

Xero automation offers a powerful solution for streamlining bookkeeping and finance processes. By automating repetitive tasks, improving data accuracy, and enhancing reporting capabilities, Xero can help outsourced finance departments deliver exceptional value to their clients while reducing costs and minimizing risks. If you’re looking to transform your bookkeeping and finance operations, consider partnering with eCloud Experts for expert Xero implementation and support