Introduction

In today’s fast-paced business landscape, small to medium-sized enterprises (SMEs) are constantly striving to achieve sustainable growth. While focusing on core business operations is crucial, effective financial management is equally essential. This is where outsourcing Xero bookkeeping can make a significant difference. By leveraging the expertise of professional bookkeepers and the power of Xero’s cloud-based accounting software, businesses can streamline their financial processes, reduce costs, and gain valuable insights to drive growth.

The Benefits of Outsourcing Bookkeeping

- Cost Efficiency: Outsourcing bookkeeping can be a cost-effective solution for SMEs. By eliminating the need for in-house accounting staff, businesses can avoid the expenses associated with salaries, benefits, and training. Additionally, outsourcing can help reduce errors and minimize the risk of financial penalties.

- Access to Expert Advice: Professional bookkeepers possess the knowledge and experience to provide valuable financial advice. They can help businesses understand their financial performance, identify areas for improvement, and make informed business decisions.

- Scalability: Outsourcing bookkeeping offers flexibility and scalability. As your business grows, your bookkeeping needs may change. With outsourced services, you can easily adjust your service level to accommodate your evolving requirements without the need for significant internal changes.

Xero: A Powerful Tool for Bookkeeping

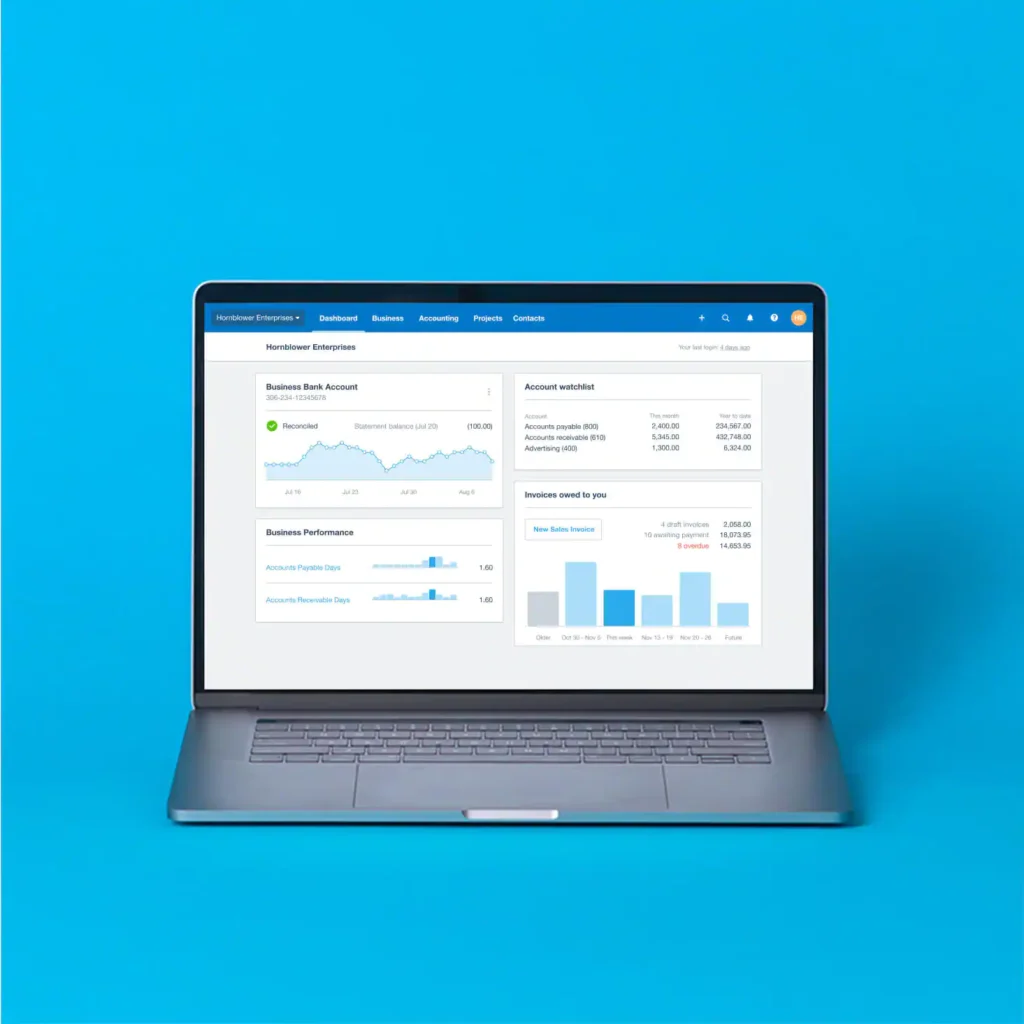

Xero is a leading cloud-based accounting software that simplifies bookkeeping tasks for businesses of all sizes. Its intuitive interface and real-time financial data make it a popular choice for SMEs. Key features of Xero include:

- Real-time financial data: Access your financial information from anywhere, anytime, allowing you to make informed decisions quickly.

- Bank feeds: Automatically reconcile your bank transactions, saving time and reducing errors.

- Invoicing and expense tracking: Easily create and send invoices, track expenses, and manage cash flow.

- Reporting: Generate customizable reports to gain insights into your business performance.

Building a Virtual Finance Department with Xero

By outsourcing your Xero bookkeeping, you can effectively establish a virtual finance department. This approach allows you to leverage the expertise of professionals without the overhead of maintaining an in-house accounting team. Here’s how to set up a virtual finance department:

- Choose a reputable bookkeeping firm: Research and select a qualified bookkeeping firm that specializes in Xero and understands your industry.

- Establish clear communication channels: Ensure effective communication between your business and the bookkeeping firm to avoid misunderstandings and delays.

- Grant necessary access: Provide the bookkeeping firm with access to your Xero account and any relevant financial documents.

- Regularly review financial reports: Stay informed about your business’s financial performance by reviewing the reports provided by your bookkeeper.

How eCloud Experts Can Help

eCloud Experts is a leading provider of outsourced Xero bookkeeping services, dedicated to helping businesses streamline their financial operations and achieve sustainable growth. With a team of experienced professionals and a deep understanding of Xero, eCloud Experts offers a comprehensive range of services tailored to meet the specific needs of SMEs.

Key services provided by eCloud Experts include:

- Xero setup and migration: Expert assistance in setting up your Xero account and migrating your existing financial data.

- Bookkeeping and accounting: Accurate and efficient bookkeeping services, including bank reconciliations, invoicing, expense tracking, and payroll processing.

- Financial reporting: Preparation of customized financial reports to provide valuable insights into your business performance.

- Tax compliance: Assistance with tax returns, VAT calculations, and other tax-related matters.

- Financial advice: Expert guidance on financial management, budgeting, and forecasting.

By partnering with eCloud Experts, you can benefit from:

- Time savings: Let experienced professionals handle your bookkeeping tasks, freeing up your time to focus on core business activities.

- Accuracy and reliability: Ensure accurate and reliable financial records, reducing the risk of errors and penalties.

- Proactive financial management: Receive expert advice and guidance to make informed business decisions.

- Scalability: Easily adjust your service level to accommodate your changing needs as your business grows.

Conclusion

Outsourcing your Xero bookkeeping to a trusted provider like eCloud Experts is a strategic decision that can significantly benefit your growing business. By leveraging the expertise of professionals and the power of Xero, you can streamline your financial processes, reduce costs, and gain valuable insights to drive growth. Consider partnering with eCloud Experts to unlock the full potential of your business’s financial management.